GST Compliance Guide for Indian Subsidiaries of Foreign Companies

A foreign company can establish its operations in India through different options, such as a Branch office, Liaison office, Project office, Subsidiary company, Limited Liability Partnership (LLP), or Joint venture. Among these, setting up a subsidiary company is one of the most popular choices for foreign companies looking to register a business in India. A foreign subsidiary operating in India must comply with the GST framework, as it is considered a separate legal entity from its parent company.

-

GST Registration:

- A foreign subsidiary must register under GST if its aggregate turnover exceeds the threshold limit prescribed for mandatory registration:

- Service providers have a turnover limit of ₹20 lakhs for GST registration, reduced to ₹10 lakhs in special category states.

- Suppliers of goods and services have a turnover limit of ₹40 lakhs for GST registration in most states.

- If the subsidiary engages in interstate taxable supply or is involved in certain other specified activities (e.g., reverse charge transactions), registration is mandatory irrespective of turnover.

- Even if the turnover is below the threshold, the subsidiary can opt for voluntary registration, which may be beneficial for claiming input tax credit (ITC) and being eligible to issue GST-compliant invoices.

- A foreign subsidiary must register under GST if its aggregate turnover exceeds the threshold limit prescribed for mandatory registration:

-

Applicability of GST:

- Depending on the type of supply (interstate or intrastate), the CGST, SGST, or IGST Acts apply to the company's delivery of goods and services.

- Under the reverse charge mechanism (RCM), importing services from the parent company or other foreign entities is taxable.

-

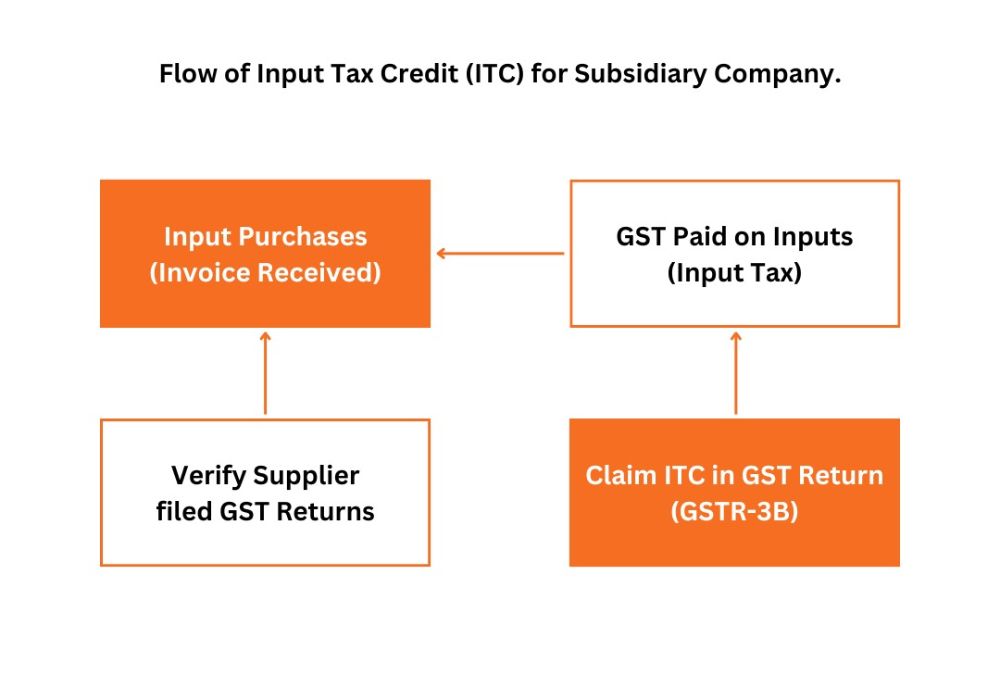

Input Tax Credit (ITC):

- The subsidiary can claim ITC for GST paid on inputs, capital goods, and input services, provided they are used for furthering its business.

- ITC cannot be claimed for blocked credits according to sec 17(5) (e.g., GST paid on personal expenses or motor vehicles used for personal purposes or employee welfare and GST used for exempt or non-taxable supplies).

- GST paid under RCM (e.g., import of services from the parent company) can be claimed as ITC if the subsidiary uses the services for taxable activities.

- Input Tax Credit (ITC) can be claimed only if the supplier has filed their GST returns and the input tax is reflected in the subsidiary's GSTR-2B.

-

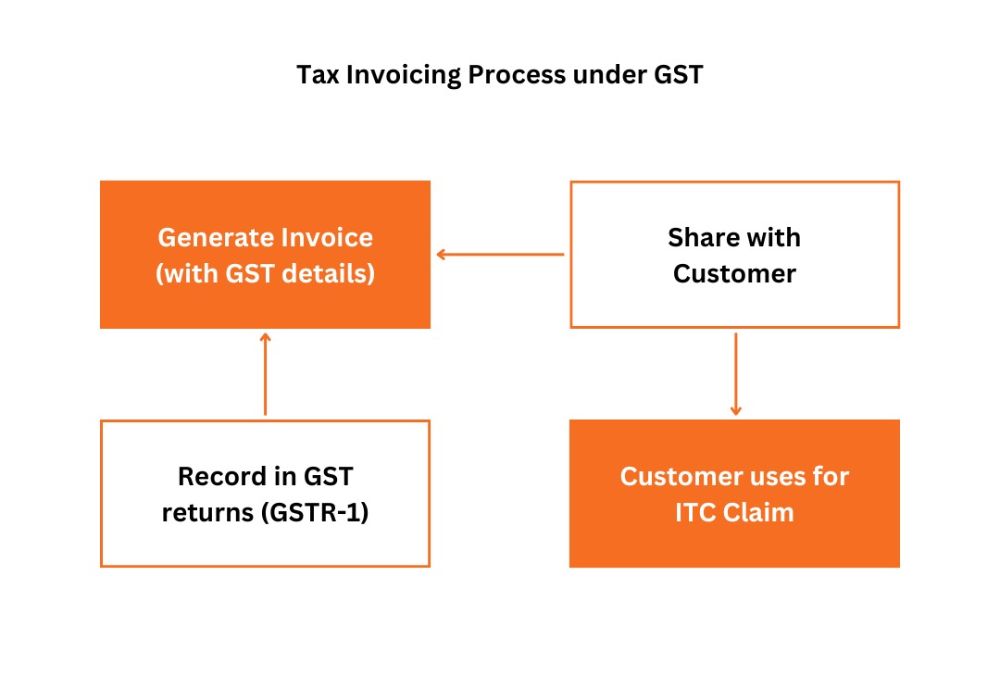

Tax Invoicing and Compliance:

- The subsidiary must issue proper GST-compliant invoices, including details such as Name, Address, GSTIN, unique invoice number, date of issue, description of goods/services, GST rates, HSN/SAC codes, quantity, unit price, and taxable value.

- If the products are being moved, the invoice must be supplied before or at the time of removal; if not, it must be issued at delivery. For services, invoices should be issued mostly within 30 days of service provisions.

- Export invoices should clearly state either "Supply meant for Export on Payment of IGST" or "Supply meant for Export under Bond/LUT without Payment of IGST" as applicable.

-

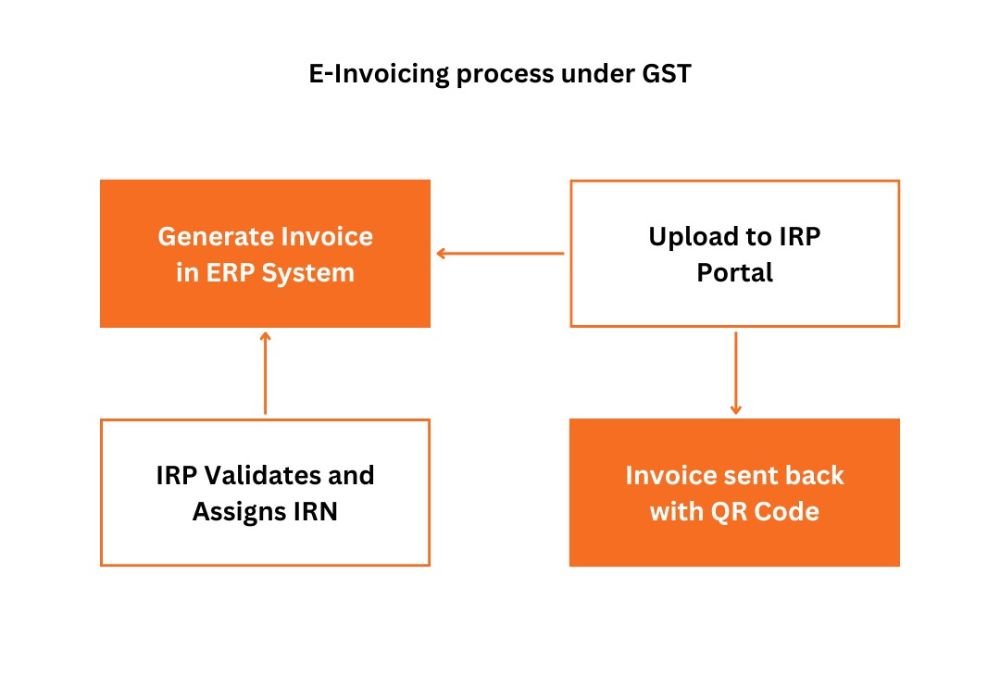

E-invoicing:

- E-invoice is mandatory for businesses exceeding the prescribed turnover threshold (currently ₹5 crore for B2B transactions). It applies to all B2B transactions, exports, and credit/debit notes but does not apply to B2C transactions or entities such as SEZ units, government departments, or specific notified persons.

- E-invoicing enhances transparency, simplifies compliance, and aligns businesses with GST's digital framework.

-

E-way Bill:

- A subsidiary company must comply with e-Way Bill regulations when involved in the movement of goods as prescribed on the GST e-Way Bill portal. For example, in Maharashtra, the limit is ₹1,00,000 or if the distance exceeds 50 km. This applies to both intra-state and inter-state transport (state rules may vary for intra-state movement).

- The subsidiary (supplier or recipient) or transporter generates the e-Way Bill on the GST e-Way Bill portal. Validity is based on distance, with a standard validity of 1 day for every 200 km or a portion thereof, though it may be extended in the event of delays or changes in the route.

-

Reverse Charge Mechanism (RCM):

- Services imported from the parent company (e.g., management fees, royalties) are subject to GST under RCM. The subsidiary must pay GST on such services and can later claim it as ITC if applicable.

- Specified goods or services include services like legal services from an advocate or goods like cashew nuts and tobacco leaves (as notified by the government); then RCM will be applicable.

- When Online Information Database Access and Retrieval (OIDAR) services are provided to registered recipients, the recipient pays the GST under RCM.

-

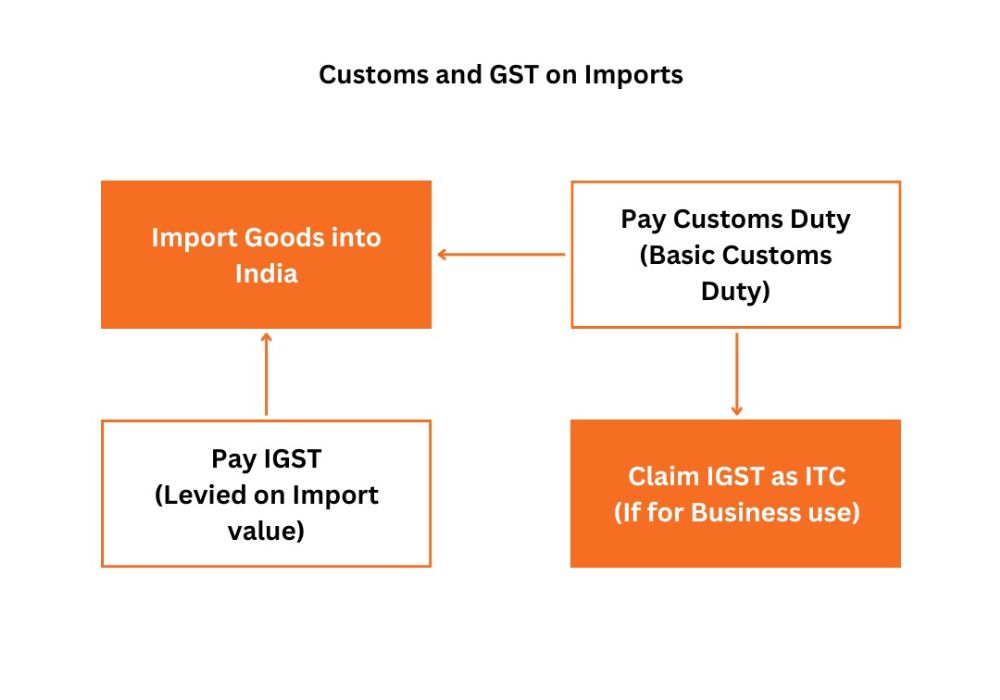

Customs and GST on Imports:

- For the import of goods, GST (IGST) is levied at the port of entry, which can be claimed as ITC if the goods are used for taxable supplies.

- For the import of goods, proper documentation, including the Bill of Entry, is necessary for compliance and claiming ITC.

-

Accounting and Record-keeping:

- The subsidiary must maintain detailed records of all transactions, invoices, and GST filings for at least six years as mandated under GST laws.

-

Role of GST in Cross-Border Transactions:

- GST implications arise for payments to the parent company, such as royalties, fees for technical services, or dividends.

- Transactions between the parent company and its subsidiary should be carefully structured to optimize tax liability under GST and income tax.

-

Special Provisions:

- Transfer Pricing: All inter-company transactions between the subsidiary and its parent company must comply with Indian transfer pricing regulations, ensuring arm's-length pricing.

- Exemptions and Zero-Rated Supplies:

- Exports by the subsidiary are zero-rated under GST, allowing refunds on input taxes paid.

- Certain activities may be exempt or attract concessional GST rates as per the government notifications.

-

Online Information and Database Access or Retrieval Services:

OIDAR services are services delivered over the Internet with minimal human intervention. Examples include online advertising, cloud services, e-books, online gaming, and distance learning programs. Foreign OIDAR service providers must register in India under GST through a simplified process with no registration threshold limit applying to such providers.

FAQs:

- Does a foreign subsidiary need to register for GST in India?

Yes, a foreign subsidiary operating in India must register for GST if its revenue exceeds the exemption threshold, which is ₹20 lakh for services and ₹40 lakh for commodities in most states. Registration is mandatory if the subsidiary is engaged in inter-state supply of goods or services or falls into specific categories such as e-commerce operators or input service distributors. Even if the revenue is below the threshold, GST registration is compulsory for subsidiaries involved in imports, exports, or operating as SEZ units. Additionally, separate GST registrations are required for operations in multiple states, though businesses under the same PAN can use a single GST number if preferred. - Is GST applicable on transactions between the parent company and its Indian subsidiary?

GST applies to taxable services or goods provided by an Indian subsidiary to its foreign parent, classifying such transactions as export of services or goods. When the Indian subsidiary receives services from its parent company, such as consulting or technical support, the reverse charge mechanism (RCM) is triggered, requiring the subsidiary to pay GST. However, commissions paid to foreign agents assisting with goods supply are generally not subject to RCM since the place of supply is deemed to be outside India. - What is the GST treatment for the export of services by a foreign subsidiary?

Exports of services by a foreign subsidiary are treated as zero-rated under GST. To qualify, the subsidiary must be in India, the recipient must be outside India, and the services must be delivered outside the country. Additionally, the supplier and recipient should not merely be two businesses owned by the same individual. Subsidiaries can either claim a refund of unutilized input tax credit (ITC) or export without paying GST by submitting a Letter of Undertaking (LUT). - Is GST applicable on the import of services by the foreign subsidiary?

Yes, imported services are subject to GST under the reverse charge mechanism (RCM). The foreign subsidiary must pay GST at the applicable rate and can claim input tax credit (ITC) if the services are used for business purposes. - Can a foreign subsidiary claim an input tax credit (ITC)?

Foreign subsidiaries can claim ITC for GST paid on purchases of goods or services used for business purposes, as well as GST paid under the reverse charge mechanism. - How should a foreign subsidiary handle GST compliance?

Foreign subsidiaries must ensure timely filing of GST returns, including GSTR-1 for outward supplies, GSTR-3B for a summary return, and GSTR-9 for the annual return. E-invoicing is mandatory for subsidiaries with an aggregate turnover exceeding ₹5 crore. Additionally, invoices must include HSN codes with 4, 6, or 8 digits based on turnover thresholds. - Are GST refunds available for foreign subsidiaries?

Foreign subsidiaries can claim refunds for unutilized ITC on zero-rated supplies such as exports or excess GST paid. Refund applications require the submission of RFD-01 along with relevant supporting documents. - Are inter-company services within India subject to GST?

GST is applicable to inter-company services, such as shared services or management fees, provided by the subsidiary to other Indian entities, even if they belong to the same parent company. - Is GST applicable to software services provided by a subsidiary to its parent company?

If the software services meet the criteria for export of services, they are zero-rated, and no GST is charged. However, if the parent company has a fixed establishment in India, GST will be applicable. - What penalties apply for GST non-compliance?

Penalties for non-compliance include late filing charges of ₹50 per day for GSTR-3B and ₹20 per day for nil returns. Incorrect returns attract a penalty of 10% of the tax due or ₹10,000, whichever is higher. Fraudulent activity can result in penalties of 100% of the tax amount or ₹10,000, whichever is greater.

The above note is subject to further study and clarification. This note does not form an opinion from our end and before taking any decision based on the above, it is recommended to consult our experts on the subject. Kamdar, Desai & Patel will not be liable for any damages (including, without limitation, damages for loss of business projects, or loss of profits) arising in contract, tort, or otherwise from the use of or inability to use this article or any of its contents, or from any action taken (or refrained from being taken) as a result of using this article or any such contents.

.png)

Vaishnavi Kamble

Author

A Senior Executive Accountant at Kamdar Desai & Patel LLP, holds a Postgraduate Diploma in Indirect Taxation, completed in 2020. As a key member of the firm's indirect tax team, she specializes in Goods and Services Tax (GST) compliance, advisory, litigation matters, and professional tax. With extensive experience in managing GST returns, audits, and assessments, Vaishnavi ensures accurate reporting and seamless compliance for a diverse clientele. Vaishnavi is proficient in leveraging her knowledge to optimize tax structures and provide practical solutions, making her an integral part of the firm's GST team.